Redington: Past, Present, Future

Which blogs did you enjoy the most in 2013?

A decade of Liability Driven Investing

Building Pensions SuperTeams

“If you want to go fast, go alone.

If you want to go far, go together.”

– African Proverb

Pensions – Two sets down, can we come back?

The enormity of Andy Murray’s win at Wimbledon last Sunday still hasn’t quite sunk in across our nation.

Continue reading “Pensions – Two sets down, can we come back?”

What are Pension Funds’ Greatest Challenges in 2013?

Pensions has always been a tricky business. But perhaps never more so than in 2013. The regulation changes of the early 2000’s rewrote the rulebook for those running pension funds, and a survey of the key challenges of that time would have produced, it seems logical to assume, a set of concerns about changing regulations, accounting issues that accompany them, and governance. Today, the landscape has changed. Pension funds, on the whole, got to grips with those systemic changes in pension infrastructure only to be faced, in 2008 onwards, with the greatest seismic economic shift of our lifetimes. It wasn’t just that markets plummeted and equities didn’t turn out to be the knight in shining armour pension funds had hoped and planned they would be; it was that the very foundations of modern economic markets changed. Everything we thought we knew about risk, return and the relationship between the two, was called into question. Now, in 2013, we are all still acclimatising to our new normal.

Continue reading “What are Pension Funds’ Greatest Challenges in 2013?”

Pitching to solve the Pensions Crisis

Last Tuesday 21st May 2013 was KPI Pitch Fest the last part of the Daniel Priestly Key Person of Influence Course. The judges were led by the iconic Mike Harris, Daniel Priestly, James Paton-Philip from Pinsent Masons, Sally Preston Founder & Managing Director at The Kids Food Company ltd, Jenny Campbell CEO at YourCash and Steve Henry Co-founder at Decoded. Thank you for an incredible opportunity and a great evening. Well done to pitch fest winner – Liz Marsh and fellow runner-ups Hannah Foxley, Karen Bailey and Viv Grant and A Rafael Dos Santos. Below I have shared my pitch from pitch fest.

Which city is a mile high and the state pension invests in infrastructure?

Denver, Colorado.

On Wednesday 6th March I was at Heathrow boarding a flight as many other pensions people were; but the flight was not to Edinburgh for the annual investment conference. Instead, I flew to Denver, the mile high city and capital of Colorado state.

Continue reading “Which city is a mile high and the state pension invests in infrastructure?”

A game of Snakes and Ladders

In the UK, as a final salary pension fund, you may be feeling as if you have just landed on a ladder and risen several rows on the board game closer to the finish: full funding. The FTSE100 equity index had its best performing January since 1989 and the S&P500 has broken through 14,000. These are levels not reached since before the onset of the Global Financial Crisis in 2007. All of this is good news for pension funds invested in equities as their funding levels will have improved significantly over the past few months.

In the US, it appears that many pension funds have landed on a “snake”, as corporate after corporate announces significant cash injections to their underfunded pension funds. So much so that, when I made a comment on Twitter about Ford’s $5billion funding of its pension fund, it elicited the response from @blackbullion “isn’t Detroit an underfunded pension fund that makes some cars?” . Ford isn’t alone in making significant cash contributions to its pension funds. It is joined by other large US corporations Honeywell, Raytheon etc. All of whom have stepped on the proverbial pensions snake.

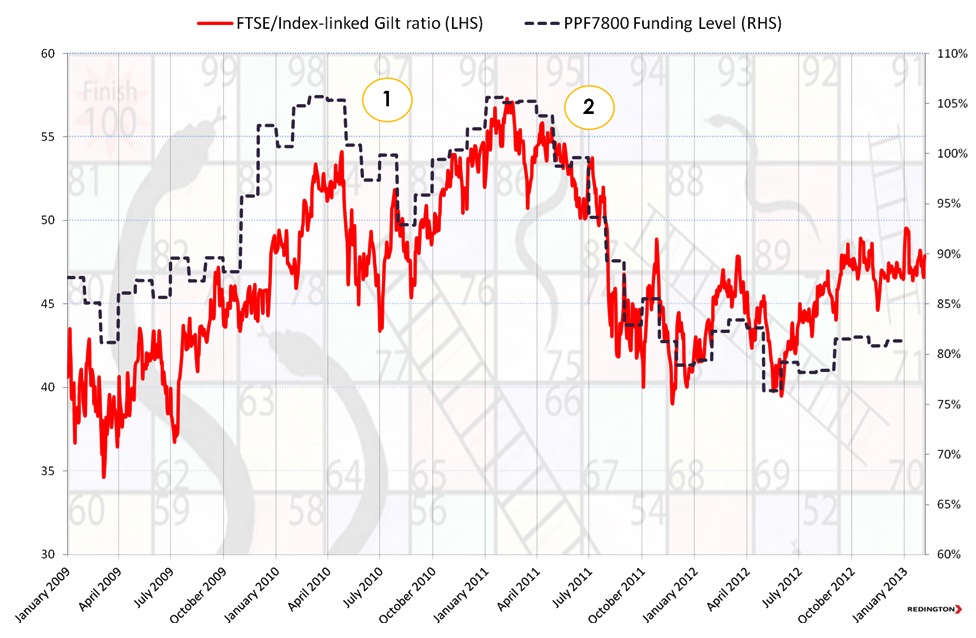

The big question is what should they do next? This highlights the difference between an “outcome focused investment strategy” or a “peers based investment strategy”. An outcome focused pension fund will have clear goals and objectives combined with regular monitoring of its assets, liabilities, funding level and perhaps its ongoing required rate of return. They will likely focus on risk and return and see the recent strong outperformance of equities over liabilities (see chart) as an opportunity to take-profit; that is, bank the outperformance of their assets over their liabilities. Within a peers based investment strategy, on the other hand, more focus is laid on the value of assets than on funding level.

The chart below shows the relative value of equities to index linked gilts plotted against the PPF 7800 funding ratio. The FTSE/Index-Linked Gilt ratio is calculated by taking the market level of the FTSE (6,000) divided by the price of the 2037 Index Linked Gilt (120). This gives a ratio of 50. The FTSE/Index-Linked Gilt ratio can be enlightening as a “rule of thumb” proxy for pension funds’ decisions to switch between equity and fixed income. Opportunities to dynamically “take profit” out of equities and into index linked gilts to hedge the liabilities are highlighted at the peaks (1) and (2). The PPF 7800 Funding Ratio is given in the background to provide context of the relative performance of a large sample of pension funds.

Chart showing the relative value of Equities (FTSE100) to Index Linked Gilts (ILG 2037) – plotted against the PPF7800 Index

Source: Bloomberg, PPF and Redington

Source: Bloomberg, PPF and Redington

Checklist for “taking profit” and dynamic risk management

- Do you have clear goals and objectives?

- Do you have take profit triggers in place?

- Are they market yield based?

- or

- Funding level based?

- or

- Versus your “Flight Plan” and you “Required Rate of Return”?

- Do you have regular monitoring in place to capture these opportunities?

- Do you have the governance and delegation to be agile and take advantage of these opportunities?

Which is better? We are all faced with the same financial uncertainty. However, if you had the opportunity to remove the big snake on the final row to the finish in exchange for removing one ladder from the board – would you? My view is that repairing the deficit and improving the security of the pensioners through prudent and disciplined risk management is the best way forward.

Happy to discuss.