What if all people feel confident about their financial future?

A game of Snakes and Ladders

In the UK, as a final salary pension fund, you may be feeling as if you have just landed on a ladder and risen several rows on the board game closer to the finish: full funding. The FTSE100 equity index had its best performing January since 1989 and the S&P500 has broken through 14,000. These are levels not reached since before the onset of the Global Financial Crisis in 2007. All of this is good news for pension funds invested in equities as their funding levels will have improved significantly over the past few months.

In the US, it appears that many pension funds have landed on a “snake”, as corporate after corporate announces significant cash injections to their underfunded pension funds. So much so that, when I made a comment on Twitter about Ford’s $5billion funding of its pension fund, it elicited the response from @blackbullion “isn’t Detroit an underfunded pension fund that makes some cars?” . Ford isn’t alone in making significant cash contributions to its pension funds. It is joined by other large US corporations Honeywell, Raytheon etc. All of whom have stepped on the proverbial pensions snake.

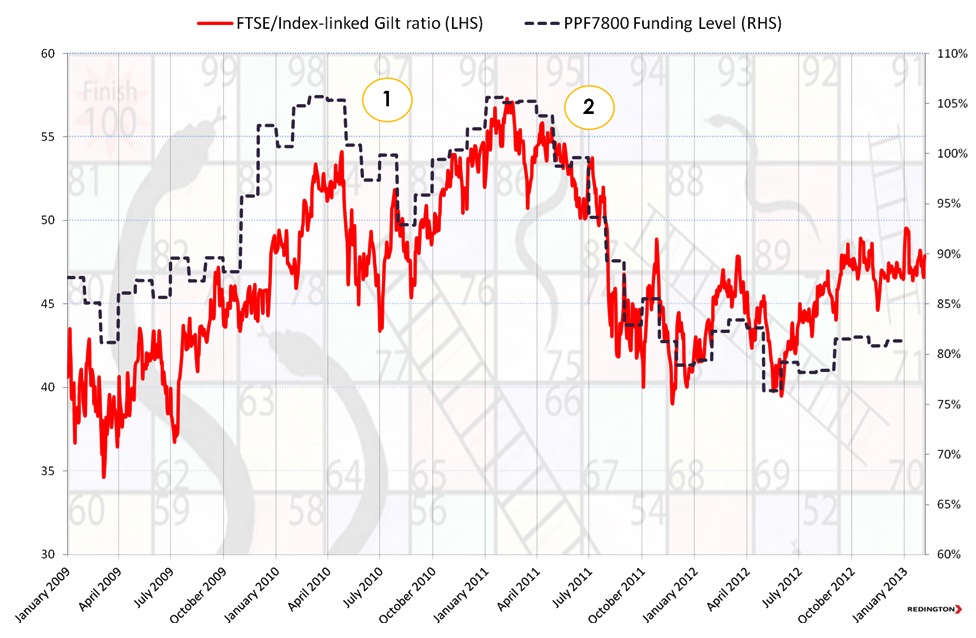

The big question is what should they do next? This highlights the difference between an “outcome focused investment strategy” or a “peers based investment strategy”. An outcome focused pension fund will have clear goals and objectives combined with regular monitoring of its assets, liabilities, funding level and perhaps its ongoing required rate of return. They will likely focus on risk and return and see the recent strong outperformance of equities over liabilities (see chart) as an opportunity to take-profit; that is, bank the outperformance of their assets over their liabilities. Within a peers based investment strategy, on the other hand, more focus is laid on the value of assets than on funding level.

The chart below shows the relative value of equities to index linked gilts plotted against the PPF 7800 funding ratio. The FTSE/Index-Linked Gilt ratio is calculated by taking the market level of the FTSE (6,000) divided by the price of the 2037 Index Linked Gilt (120). This gives a ratio of 50. The FTSE/Index-Linked Gilt ratio can be enlightening as a “rule of thumb” proxy for pension funds’ decisions to switch between equity and fixed income. Opportunities to dynamically “take profit” out of equities and into index linked gilts to hedge the liabilities are highlighted at the peaks (1) and (2). The PPF 7800 Funding Ratio is given in the background to provide context of the relative performance of a large sample of pension funds.

Chart showing the relative value of Equities (FTSE100) to Index Linked Gilts (ILG 2037) – plotted against the PPF7800 Index

Source: Bloomberg, PPF and Redington

Source: Bloomberg, PPF and Redington

Checklist for “taking profit” and dynamic risk management

- Do you have clear goals and objectives?

- Do you have take profit triggers in place?

- Are they market yield based?

- or

- Funding level based?

- or

- Versus your “Flight Plan” and you “Required Rate of Return”?

- Do you have regular monitoring in place to capture these opportunities?

- Do you have the governance and delegation to be agile and take advantage of these opportunities?

Which is better? We are all faced with the same financial uncertainty. However, if you had the opportunity to remove the big snake on the final row to the finish in exchange for removing one ladder from the board – would you? My view is that repairing the deficit and improving the security of the pensioners through prudent and disciplined risk management is the best way forward.

Happy to discuss.

RedMaze – can you run the risk?

Help get your scheme to full funding on your daily commute in RedMaze.

Help get your scheme to full funding on your daily commute in RedMaze.

The game injects a bit of entertainment to your daily travels and adds a little light relief to the pensions situation.

In a brand new twist of an arcade classic, navigate your way through the mazes, collect all the contributions and avoid the “Risk Raiders”.

- Can you run the risk of equity bears, inflation, longevity and interest rate doves?;

- It’s not always doom and gloom – tides can turn and conditions can change in your favour;

- Collect special contributions and turn the equity bear into an equity bull, morph the interest rate dove into an interest rate hawk, nullify inflation and say goodbye to grandpa Joe…

It’s easy to get lost in the pensions maze…but that’s why it’s important to know your goals, understand your risks, plan a strategy and have a robust framework.

Get in touch to find out more.

Available now for the iPhone. Free to download on the App Store:

http://itunes.apple.com/gb/app/redmaze/id428938104?mt=8&ls=1