Continue reading “How much do I need to save for my retirement?”

What if all people feel confident about their financial future?

What lessons can be learnt from the Olympics? the importance of mindset, skill set and toolset

On Friday 27th July 2012 the London Olympics inspired the world. Athletes in Team GB, such as, Jessica Ennis, Mo Farrah, and Andy Murray demonstrated to the world the ability to win gold medals and achieve incredible goals. What is the common thread of high performance that these and all other olympic athletes demonstrate? Can we learn from them and apply them to solve the global pensions challenge? I have identified 3, the importance of mindset, skill set and toolset:

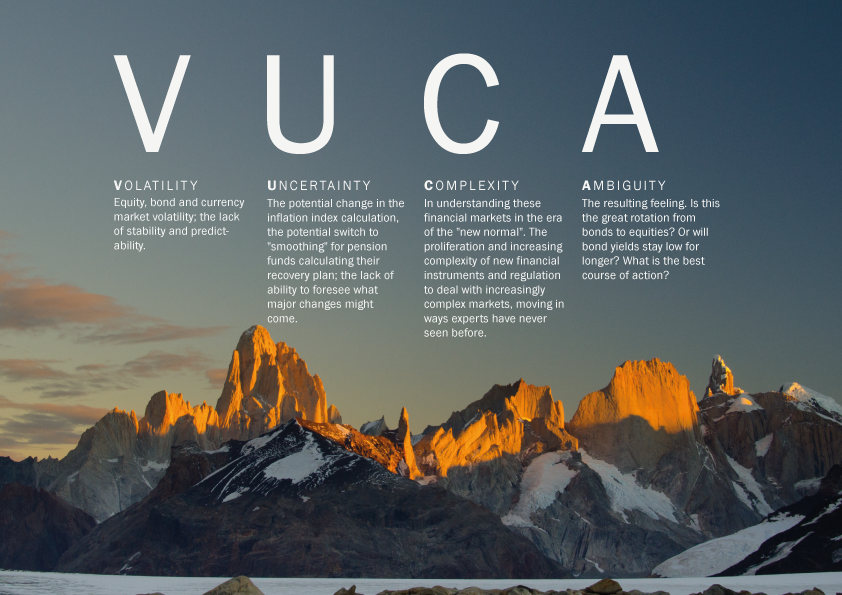

VUCA – The Acronym of our Time

For those managing personal or institutional money, the world is becoming more Volatile, Uncertain, Complex and Ambiguous.

Staying Classy – Sharing Ideas and Repairing Pensions Deficits

Last week, we at Redington released an annual publication called Asset Class 2013. It was put together by Redington Head of IC David Bennett and his team of consultants, who deal with over £270 bn of assets and the people who run those assets, on a daily basis, helping them to repair deficits and improve member security through smart investment strategy.

Continue reading “Staying Classy – Sharing Ideas and Repairing Pensions Deficits”

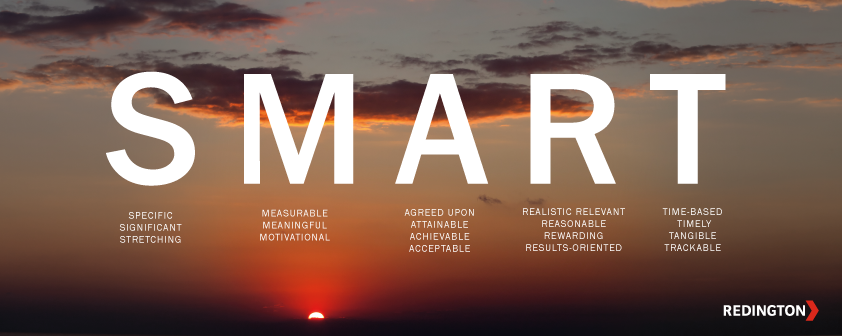

Are you SMART? How pension funds can set the right kinds of goals.

Pension funds face an eternally difficult process of setting goals and then making sure they reach them. It doesn’t sound complicated, but it is.

Continue reading “Are you SMART? How pension funds can set the right kinds of goals.”

Pitching to solve the Pensions Crisis

Last Tuesday 21st May 2013 was KPI Pitch Fest the last part of the Daniel Priestly Key Person of Influence Course. The judges were led by the iconic Mike Harris, Daniel Priestly, James Paton-Philip from Pinsent Masons, Sally Preston Founder & Managing Director at The Kids Food Company ltd, Jenny Campbell CEO at YourCash and Steve Henry Co-founder at Decoded. Thank you for an incredible opportunity and a great evening. Well done to pitch fest winner – Liz Marsh and fellow runner-ups Hannah Foxley, Karen Bailey and Viv Grant and A Rafael Dos Santos. Below I have shared my pitch from pitch fest.

Match.com? Making the pensions and infrastructure romance work

Since George Osborne’s autumn statement in 2011, pension funds and their advisors have been discussing the idea of investing in infrastructure. And the logic for this investment is sound: pension funds need low risk, long dated inflation-linked cash flows. They always have, they always will. Happily, the UK needs new infrastructure, much of the funding for which is long-dated and inflation-linked. Banks, which previously funded these endeavours, are no longer funding them, and pension funds seem to be the natural rebound relationship that might just turn steady. Why, then, has making this partnership happen been so tough?

Continue reading “Match.com? Making the pensions and infrastructure romance work”

Why I left Merrill Lynch to become an entrepreneur?

Seven years ago, today, on Friday 31st March 2006 I resigned from Merrill Lynch. I loved my time at Merrill Lynch; I loved the work, the energy, my colleagues and the challenge of investment banking. In fact, I had only just been promoted to Director in the Insurance & Pensions Solutions Group and I certainly didn’t know there was an inbound “Global Financial Crisis” around the corner. So why resign?

Continue reading “Why I left Merrill Lynch to become an entrepreneur?”

The genius of the AND versus the tyranny of the OR

Current debate over Defined Benefit (DB) pensions has captured the attention of the public and press. People are living longer, investment returns are lower than expected, and economic uncertainty has led to the closure of DB pension funds to future accrual in order to cap the ever rising cost of servicing these liabilities. Following these lethal blows, 2012 saw the introduction of auto-enrolment, and in 2013 the Department for Work and Pensions (DWP) is consulting on the topic of whether the industry should change the discount rate used to value liabilities to a smoothed one, in order to reduce the impact of current low gilt yields.

However, we are still faced with two serious challenges that have yet to be fully faced:

Continue reading “The genius of the AND versus the tyranny of the OR”