These are tough times for pension schemes, with market moves impacting both the asset and liability side of their balance sheets. Should trustees rebalance their equity holdings as the market drops, use this opportunity to reallocate assets to alternative classes or remain on hold and wait for the turbulence to subside?

These are tough times for pension schemes, with market moves impacting both the asset and liability side of their balance sheets. Should trustees rebalance their equity holdings as the market drops, use this opportunity to reallocate assets to alternative classes or remain on hold and wait for the turbulence to subside?

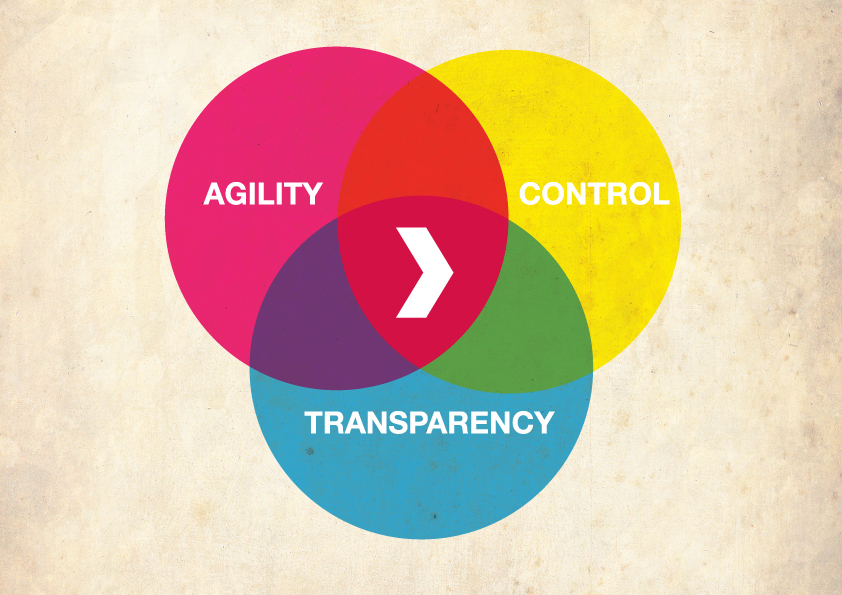

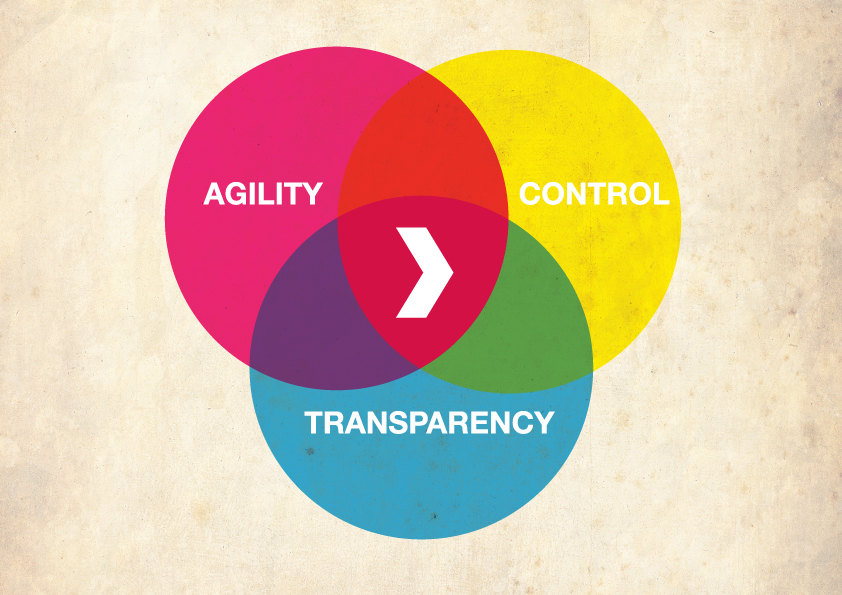

Without a plan, making these decisions in the depths of a crisis can often do more harm than good. I believe Good Governance involves three key concepts, which combine to allow trustees to take appropriate decisions even in the heat of adverse market moves:

Good Governance = Ability to ACT, where:

- A = AGILITY to make and implement decisions

- C = CONTROL, provided by a robust pension risk framework

- T = TRANSPARENCY on both assets and liabilities

- Agility allows decision-makers to act swiftly whenever the need arises. Pension schemes, as long term investors, need to be nimble when attractive long term opportunities arise – this may involve adding to risk, reducing risk or re-allocating risk in a short space of time. Before making any decision, trustees must ensure they are in Control…

- Control comes from setting a robust framework to monitor and manage a pension scheme’s risk. Ideally this framework would be in place BEFORE any market turbulence. At Redington, we help our clients put together a Pension Risk Management Framework (PRMF), within which agile decisions can be made. To be in control, you need Transparency…

- Transparency is required on both assets and liabilities to allow an up-to-date funding level to be reported. On the liability side, this involves accurate actuarial analysis around future payments to retirees. On the asset side, it involves regular and timely updates on pricing of investments. Transparency is particularly important during times of market stress.