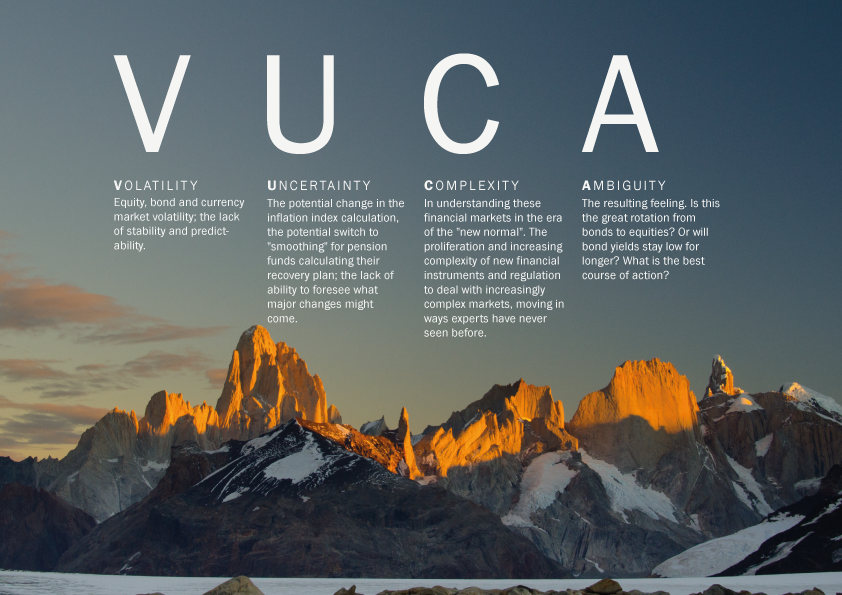

For those managing personal or institutional money, the world is becoming more Volatile, Uncertain, Complex and Ambiguous.

Pensions – Two sets down, can we come back?

The enormity of Andy Murray’s win at Wimbledon last Sunday still hasn’t quite sunk in across our nation.

Continue reading “Pensions – Two sets down, can we come back?”

Staying Classy – Sharing Ideas and Repairing Pensions Deficits

Last week, we at Redington released an annual publication called Asset Class 2013. It was put together by Redington Head of IC David Bennett and his team of consultants, who deal with over £270 bn of assets and the people who run those assets, on a daily basis, helping them to repair deficits and improve member security through smart investment strategy.

Continue reading “Staying Classy – Sharing Ideas and Repairing Pensions Deficits”

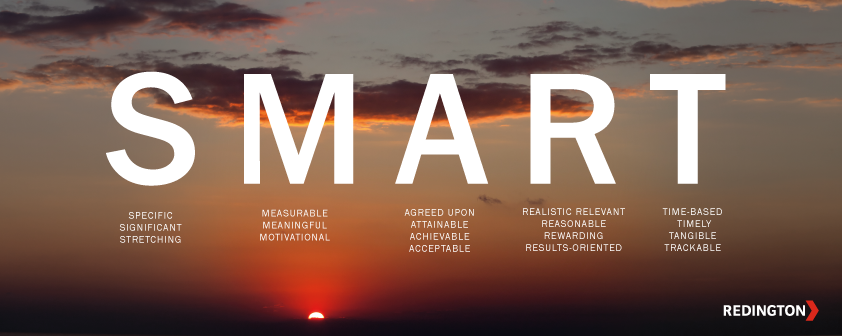

Are you SMART? How pension funds can set the right kinds of goals.

Pension funds face an eternally difficult process of setting goals and then making sure they reach them. It doesn’t sound complicated, but it is.

Continue reading “Are you SMART? How pension funds can set the right kinds of goals.”

Are you interested in investing in Infrastructure, Social Housing and Property?

HM Government are urging pension funds and insurers to increase their investment in UK infrastructure and housing. See Match.com? Making the pensions and infrastructure romance work. But what do these asset classes offer pension funds and insurance companies and do the potential rewards really justify the additional governance and risk?

Continue reading “Are you interested in investing in Infrastructure, Social Housing and Property?”

What are Pension Funds’ Greatest Challenges in 2013?

Pensions has always been a tricky business. But perhaps never more so than in 2013. The regulation changes of the early 2000’s rewrote the rulebook for those running pension funds, and a survey of the key challenges of that time would have produced, it seems logical to assume, a set of concerns about changing regulations, accounting issues that accompany them, and governance. Today, the landscape has changed. Pension funds, on the whole, got to grips with those systemic changes in pension infrastructure only to be faced, in 2008 onwards, with the greatest seismic economic shift of our lifetimes. It wasn’t just that markets plummeted and equities didn’t turn out to be the knight in shining armour pension funds had hoped and planned they would be; it was that the very foundations of modern economic markets changed. Everything we thought we knew about risk, return and the relationship between the two, was called into question. Now, in 2013, we are all still acclimatising to our new normal.

Continue reading “What are Pension Funds’ Greatest Challenges in 2013?”

Pitching to solve the Pensions Crisis

Last Tuesday 21st May 2013 was KPI Pitch Fest the last part of the Daniel Priestly Key Person of Influence Course. The judges were led by the iconic Mike Harris, Daniel Priestly, James Paton-Philip from Pinsent Masons, Sally Preston Founder & Managing Director at The Kids Food Company ltd, Jenny Campbell CEO at YourCash and Steve Henry Co-founder at Decoded. Thank you for an incredible opportunity and a great evening. Well done to pitch fest winner – Liz Marsh and fellow runner-ups Hannah Foxley, Karen Bailey and Viv Grant and A Rafael Dos Santos. Below I have shared my pitch from pitch fest.

Happy 7th Birthday Team Redington – lessons about teamwork

Happy Birthday Team Redington! Seven years ago on 16th May 2006 Redington was founded.

Teams are essential in solving the world’s most complex challenges. And solving the global pensions challenge is, without a doubt, one that requires collective action. One could even say, because of its scale and gravity, that it requires a ‘Super Team’.

Continue reading “Happy 7th Birthday Team Redington – lessons about teamwork”

Match.com? Making the pensions and infrastructure romance work

Since George Osborne’s autumn statement in 2011, pension funds and their advisors have been discussing the idea of investing in infrastructure. And the logic for this investment is sound: pension funds need low risk, long dated inflation-linked cash flows. They always have, they always will. Happily, the UK needs new infrastructure, much of the funding for which is long-dated and inflation-linked. Banks, which previously funded these endeavours, are no longer funding them, and pension funds seem to be the natural rebound relationship that might just turn steady. Why, then, has making this partnership happen been so tough?

Continue reading “Match.com? Making the pensions and infrastructure romance work”

Why I left Merrill Lynch to become an entrepreneur?

Seven years ago, today, on Friday 31st March 2006 I resigned from Merrill Lynch. I loved my time at Merrill Lynch; I loved the work, the energy, my colleagues and the challenge of investment banking. In fact, I had only just been promoted to Director in the Insurance & Pensions Solutions Group and I certainly didn’t know there was an inbound “Global Financial Crisis” around the corner. So why resign?

Continue reading “Why I left Merrill Lynch to become an entrepreneur?”