For those managing personal or institutional money, the world is becoming more Volatile, Uncertain, Complex and Ambiguous.

The globalisation of the world economy, combined with the acceleration of technology, means equity, bond and currency markets are more volatile than ever. The 2008 Global Financial Crisis has been followed by bouts of volatility on the back of economic or political bad news like the developments in Greece and Europe and question marks like Quantitative Easing (QE) tapering in the US.

And the world is more uncertain, too, as a result of rapidly evolving geo political systems, rules and regulations that impact the countries we live in, the companies we work for and the markets we invest in. The challenges we face are increasingly complex; the products and services we need to help us solve them are increasing in complexity too.

The result of this triumvirate of volatility, uncertainty and complexity is overwhelming ambiguity: the root of the quiet desire to bury one’s head in the sand and hope for better, easier times. Like the old days.

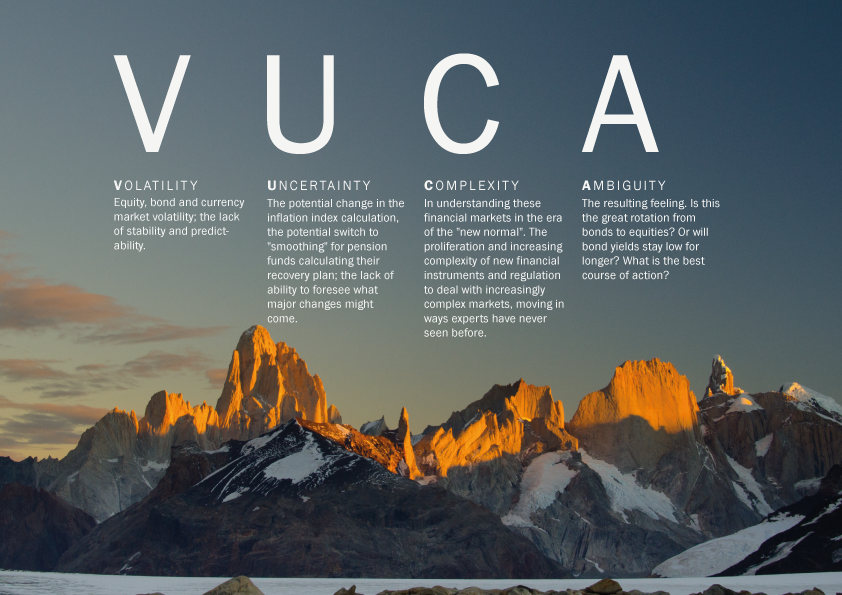

These characteristics occur in so many areas of life, and so great are the effects of this concoction of four that the US military even gave it an acronym: VUCA. For us in pensions and finance, VUCA in 2013 refers to:

• Volatility – equity, bond and currency market volatility; the lack of stability and predictability.

• Uncertainty – the potential change in the RPI inflation index calculation, the potential switch to “smoothing” for pension funds calculating their recovery plan; the lack of ability to foresee what major changes might come.

• Complexity – in understanding these financial markets in the era of the “new normal“. The proliferation and increasing complexity of new financial instruments and regulation to deal with increasingly complex markets, moving in ways experts have never seen before.

• Ambiguity – the resulting feeling. Is this the great rotation from bonds to equities? Or will bond yields stay low for longer? What is the best course of action?

The Volatility, Uncertainty, Complexity, and Ambiguity inherent in today’s financial world is the new normal. And it is profoundly changing not only how organizations do business, but how leaders lead and how pension funds are managed. The skills and abilities leaders once necessary to thrive are no longer sufficient or even applicable.

Today, more strategic, complex, critical-thinking skills are required of pension fund stakeholders to counter the effects of VUCA. In fact, what’s needed in pensions is a counter-VUCA: the Vision to imagine and design a long-term strategy that repairs the pension deficit and improves member security; one that pulls all stakeholders together and unifies their goal and effort in a common purpose. Then the Understanding of all the options available to pension funds to reach those goals; through education, hard work and diligence, a level of comfort and understanding about complex financial products must be reached in order to capture the opportunities that lead to success. Third, let’s target Clarity in goals, constraints and accountability by using SMART principles in goal setting. And finally, pension funds must, if they are to reach their goals, achieve a level of Agility – speed and efficiency in decision-making; not haste.

Together, these four characteristics can be used to design a better future for pension funds, by repairing their deficits, and improving their members’ security.

So if volatility is mainly home in equity, bond and currency markets – why not stay out and focus on alternative, private and real asset markets instead? I’ve stopped looking at and investing in financial markets in 2001. However I know it’s more complex for Pensions Funds than private investors.

Great understanding & insight, Robert. I could not agree more with your assessment of the current conditions we operate in, and the need for a counter VUCA in pensions. However there are very few individuals that understand enough of the current VUCA to rise above and deliver the clarity of thought to drive appropriate strategies forward.