Continue reading “My #ALSIceBucketChallenge supporting @mndassoc & @charitywater”

2011 in review

The WordPress.com stats helper monkeys prepared a 2011 annual report for this blog.

Here’s an excerpt:

A San Francisco cable car holds 60 people. This blog was viewed about 2,400 times in 2011. If it were a cable car, it would take about 40 trips to carry that many people.

Social Media And Pensions 2.011

“It’s up to us to intimately understand how social media impacts the bottom line and how we can steer experiences, conversations, and action in our direction, while delivering value. Without engagement, we cannot compete for relevance. Without relevance, we cannot compete.” – Brian Solis, Social Media Guru

“It’s up to us to intimately understand how social media impacts the bottom line and how we can steer experiences, conversations, and action in our direction, while delivering value. Without engagement, we cannot compete for relevance. Without relevance, we cannot compete.” – Brian Solis, Social Media Guru

Social media has taken the world by storm with over 1 billion users. 700 million people are registered on Facebook and a new member joins LinkedIn every second! It began as a way for individuals to share their thoughts and update friends/family on events in their life but is now challenging traditional business models.

Social Media 2.0 enhances the personal aspect, bringing in a professional side too. Top consumer brands spend an increasing portion of their marketing budget on these digital platforms as research shows that social media conversations affect reputation, credibility, sales and, ultimately, profitability. Current relationships can be developed and new ones found without the need to leave your computer – the whole world is literally at your fingertips!

I have been exploring this uncharted social media for about 5 years. As co-founder of Mallowstreet, an online social network for the pensions’ community, I truly believe in its power to engage stakeholders and transform the way we deliver information and ideas.

In a business sense, creating a notable online presence helps to build trust with current and potential clients. It allows you to leverage your personal brand to promote your professional one. It also allows groups of otherwise unconnected individuals to gather and share in the wisdom of the crowd, through posting of ideas and 2-way discussions.

My approach to social media is one of giving – I believe we can all contribute as individuals in a way that adds value to the whole. With pensions’ dialogue and debate so prominent in society, this new media offers a great opportunity to engage with others in the industry as well as engage and educate non-pensions’ folk.

Let me describe how I use social media on a day-to-day basis:

– Facebook – Stay in contact with friends and family

– Small and personal number of ‘Friends’

– Follow a number of business pages to receive automatic news updates, such as TED, Economist, Harvard Business Review

– Set-up “Redington” business page to promote services and share knowledge

– LinkedIn – Connect with people after a meeting or conference

– Participate in online pension forums and discussions

– Use Q+A section to tap into a deep well of expert knowledge

– Share my posts from other social media platforms

– Twitter – Allows serendipitous reading of interesting topics

– Share my thoughts and post articles or links for others

– Use of hashtags, such as #Pensions to identify relevant stories

– Follow news channel tweets to save time trawling through websites

– Develop deeper relationships through re-tweets, mentions and messages

Twitter hashtags were popularised during the San Diego forest fires in 2007 when Nate Ritter used #sandiegofire to identify his updates related to the disaster.

In 2011, the annual pensions conference suggested using #Pensions2011, which led one actuary to suggest receiving CPD points for following #Pensions2011 on Twitter!

Don’t be caught off-guard, make sure you research the pros and cons of this key communication, networking and collaborating tool. There is no set of instructions on how to use social media for your business or personal pleasure. It can only deliver success through experimentation and regular participation.

With the development of 3G networks, the cost of being online has fallen dramatically. With networks and networking available 24/7/365, the cost of staying offline may rise even more dramatically!

Of course, it’s not all about #Pensions and #SocialMedia. #Tennis provides me with the latest news on my other favorite subject!

Please feel free to follow me on Twitter (@robertjgardner) or connect with me on LinkedIn.

– Just published in the Actuary September 2011 – “Pensions networking”

Hyperlinks used in article

- http://en.wikipedia.org/wiki/Brian_Solis

- http://www.mallowstreet.com/

- https://www.facebook.com/home.php#!/robertjgardner

- http://www.facebook.com/pages/Redington/265899018344?sk=app_228655823824391

- http://twitter.com/search/pensions

- http://twitter.com/search/socialmedia

- http://twitter.com/search/tennis

- http://twitter.com//robertjgardner

- http://www.linkedin.com/in/robertjgardner

NAPF Investment Council – I am standing for election and would love your support

As a member of the NAPF investment council, I will endeavour to make a valuable contribution to getting better outcomes for both defined benefit and defined contribution members.

As a member of the NAPF investment council, I will endeavour to make a valuable contribution to getting better outcomes for both defined benefit and defined contribution members.

I have spent the last 8 years developing, creating and implementing investment solutions to meet the ever changing regulatory, governance, and (financial) market conditions. In 2003 I was involved with the first derivative LDI transaction with Friends Provident whilst working at Merrill Lynch which remains one of my career’s most valued achievements. In 2006, I followed my passion and setup up Redington, alongside my business partner, aspiring to become a well respected and progressive investment consultancy. Whilst at Redington I have worked with both small and large clients and gained an invaluable insight into the multi faceted challenges (especially investment) facing the pension industry today.

I am passionate about fostering solutions such as investing in social housing and un-leveraged UK infrastructure assets to source long-dated inflation linked cash flows. I believe the NAPF council is the right forum for discussing the utilisation of such solutions, and think my experiences will bring forth a unique, yet collaborative perspective of many trustees and corporate clients whom I have been fortunate to work with.

Commando Spirit – Nothing Impossible!

As you heard last week at the mallowstreet exchange I have volunteered to take on a challenge of a lifetime and face the formidable “Dunker” this September – A terrifying underwater escape exercise all Royal Marines face as part of their arduous training to gain their green beret.

I am asking you to do one or both of the following to support me and Commando Spirit in my efforts:

- Donate Now. Visit my JustGiving page and make a (very) generous donation towards my £10,000 fund raising target and the Commando Spirit Series’ mission to help raise £6m by 2014 in order to help the Royal Marines in their time of need.

- Escape the dunker with me at Royal Naval Air Station (RNAS) Yeovilton on Saturday the 17th September and help raise even more money to support our Royal Marines and their families in need. Register at Commando Spirit.

- Excellent news – Mark Rowlinson (@markjrowlinson) has agreed to Escape the Dunker and I know a few others were very keen to join the action.

- A few photos taken by Bob Owen – Royal Marine photographer – http://on.fb.me/jK0j5d

So what will I be doing in September 2011?

Well, I will be trained at the Underwater Escape Training Unit and then I will be strapped into a fuselage and required to escape from a somewhat frighteningly realistic simulation of a helicopter crash at sea, in the dark, upside down, using the correct procedure. I’ve been assured it does not take physical strength – what it tests is courage, determination, fortitude and teamwork, as well as the ability to follow instructions and stay calm!

As Commando Spirit Ambassador and former Royal Marine says:

“I vividly recall my first experience in the dunker – my racing heartbeat and clammy palms as the waters rose around me. Although 100% safe it is nonetheless a great test of mettle, and a life enhancing experience for those who take part. You’ll turn up trembling and swagger out beaming, ready to take on the world”

Why the Royal Marines Charitable Trust Fund?

The Royal Marines Charitable Trust Fund helps Royal Marines and their families when they need it most.

- They aid the wounded and injured.

- They give quality of life to those returning from operations.

- And when the worst happens, they support the families of those who die in service.

The RMCTF has the widest purposes of almost any service charity – quite simply, the Royal Marines Charitable Trust Fund will help when others cannot.

Enchanting GenY to Plan, Save, Retire = Games + Social Media

Dear Sophie –

I was delighted to read Keyur Patel’s article about banks’ relationships with the ‘Generation Y’. Storytelling is often used to educate young people to strive for greatness, inspire change and motivate action. I believe that if done properly and mindfully games can be the 21st century equivalent of Aesop’s fables.

I agree with Keyur there should be more engagement through mediums such as gaming to help educate Generation Y in the principles of finance. Check-out

http://www.56sagestreet.co.uk/.

To win in this game, you are required to do as many paid jobs as possible, whilst keeping a close eye on your ‘energy’ and ‘appearance’. However the game is not just about making money, it’s also about making the best decisions and using money wisely to progress through the City. Some jobs pay well, while others will have other benefits, such as boosting your reputation. Finally, using Facebook Connect, players can share their progress and spread the game.

I believe using social media technologies to connect and communicate with Generation Y is essential to helping them Plan, Save and Retire. With the demise of final salary pensions, Generation Y will only save enough money today if we make pensions engaging, interesting, intuitive and FUN! This can be achieved by embracing the use of games on smart phones and social media.

Robert Gardner is a pension consultant at Redington and an advocate of social media.

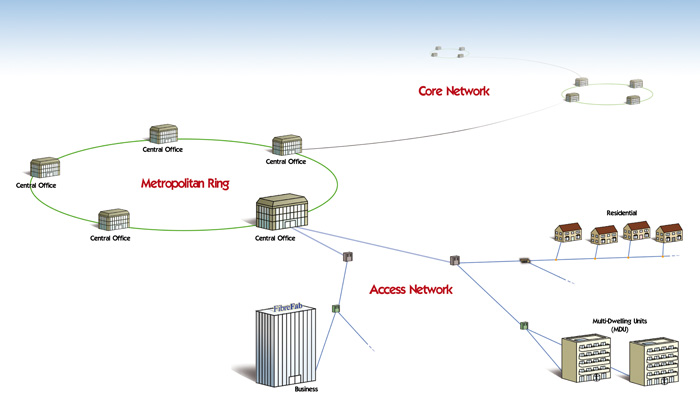

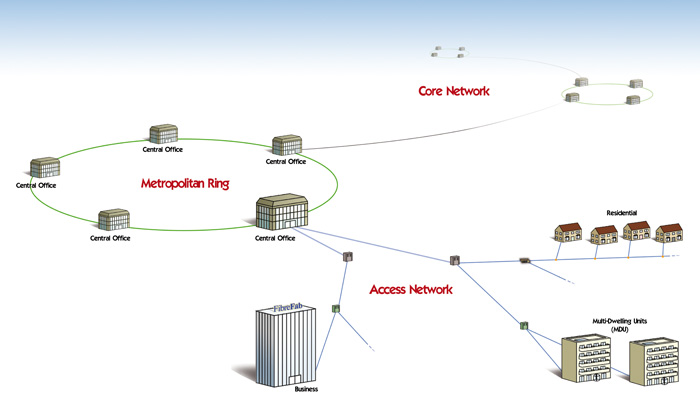

The 4th Utility – superfast broadband network

Will next generation “Fibre to the Home” (FTTH) networks be the 4th Utility?

Will low cost, unlimited capacity digital networks be tomorrow’s world?

Who will be the utility providers of this 4th Utility?

Who will be the providers of capital to fund these projects?

Note our Universities already have JANET the UK’s education and research network (http://www.ja.net/index.html).

Fujitsu unveils plans to bring fibre to 5 million homes and businesses in rural Britain

London, 13th April 2011 — Fujitsu, one of the world’s largest technology and communications companies, today announced plans to work in collaboration with Virgin Media, TalkTalk and Cisco to deliver next generation internet services to 5 million homes in rural Britain.

The collaboration and subsequent Fujitsu build of a new superfast, fibre optic broadband network is a ground breaking and innovative alternative to BT Openreach and provides an opportunity for any community or local authority looking to access a proportion of the £530 million earmarked by the UK Government to drive investment in superfast broadband in rural communities.

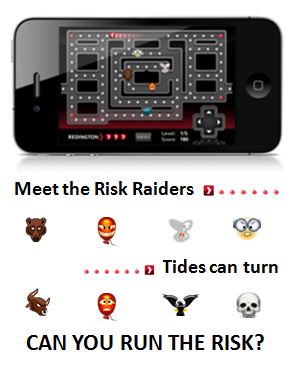

RedMaze – can you run the risk?

Help get your scheme to full funding on your daily commute in RedMaze.

Help get your scheme to full funding on your daily commute in RedMaze.

The game injects a bit of entertainment to your daily travels and adds a little light relief to the pensions situation.

In a brand new twist of an arcade classic, navigate your way through the mazes, collect all the contributions and avoid the “Risk Raiders”.

- Can you run the risk of equity bears, inflation, longevity and interest rate doves?;

- It’s not always doom and gloom – tides can turn and conditions can change in your favour;

- Collect special contributions and turn the equity bear into an equity bull, morph the interest rate dove into an interest rate hawk, nullify inflation and say goodbye to grandpa Joe…

It’s easy to get lost in the pensions maze…but that’s why it’s important to know your goals, understand your risks, plan a strategy and have a robust framework.

Get in touch to find out more.

Available now for the iPhone. Free to download on the App Store:

http://itunes.apple.com/gb/app/redmaze/id428938104?mt=8&ls=1

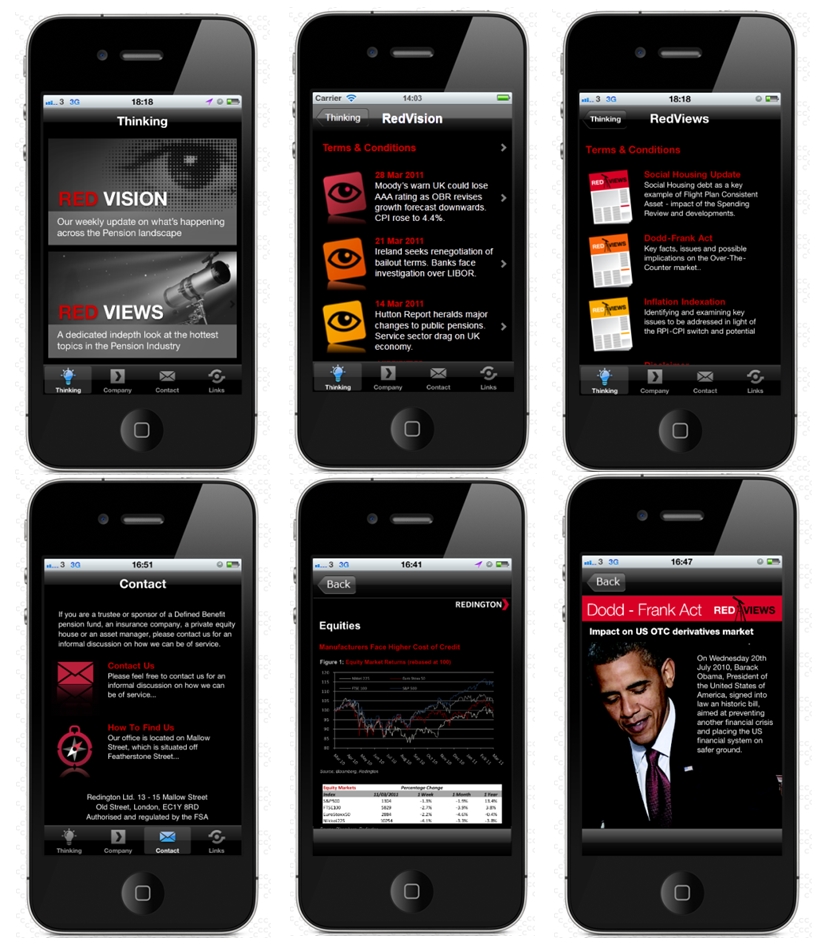

Redington App

As advocates of social media, we’re always looking for more efficient ways of spreading information, educating the community and disseminating our ideas.

The Redington App lets users stay up-to-date with the latest pensions thinking on the go, with access to RedVision, our weekly analysis of financial markets and RedViews, cutting-edge ideas on pensions risk management developments in the industry.

The content is all available at the touch of a button. Regular weekly updates are available with wifi connection.

Free to download from the App Store now:

http://itunes.apple.com/gb/app/redington/id427950128?mt=8

Enjoy.

Rob

Dear Father Christmas – A Wish List for 2011

‘Twas the night before tri-annual funding, and all through portfolio, not an asset was falling…but then I woke up!

‘Twas the night before tri-annual funding, and all through portfolio, not an asset was falling…but then I woke up!

Father Christmas, I wish for many things in my stocking this year: higher yields, lower inflation, rising markets and stronger sponsors. But in the meantime, this Christmas, I’m asking for: new investment opportunities, a better understanding among ourselves of why we should all save for retirement as well as an industry that embraces a new era of collaboration and communication.

Pension Funds – Social Capitalists

The financial crisis brought with it the need for new sources of long-term funding. The new age of austerity has inadvertently created countless win-win opportunities for long-term investors and those that requiring funding. Because their liabilities are long-term, pension funds are ideally suited for accessing significant illiquidity premia. They can provide patient long-term capital for a huge variety of undertakings. They can fund roads, railways, ports, hospitals, social housing, clean energy and many other projects that bring huge benefits to society.

Pension funds can not only earn handsome and secure returns this way. Society as a whole profits when money is readily available for such projects. If only they find the courage and vision, pension funds can be social capitalists – combing profit and general welfare.

Communication – Making Informed Decision

There is a lack of communication between the pension industry and the wider population. Most members of Generation Y have a rather relaxed attitude to pensions. Their motto is: spend today and save tomorrow. They will only put something into their pension pots if some money happens to be left by the end of the month. Even those who save money month in, month out are more likely to aim for the new golf clubs or the funky holiday getaway than a decent pension.

The chance that this behaviour will secure you a comfortable retirement is just as high as the success chances of England’s recent World Cup bid. Bad preparation cannot be made good by some showy performance right at the end – and we shouldn’t hope for a royal prince, the prime minister or David Beckham being there to help us sort out our pensions. People on the street need to understand how important it is to save for retirement. And this is much more challenging to get across than explaining how to set up the monthly withdrawal from their bank accounts.

Collaboration – Getting Everybody Onboard

The pensions industry is in desperate need of more and better collaboration. Even with the rise of technology, social media and flashy gadgets like the iPhone I’ve noticed that the pensions industry remains unconnected. Trustees tell me they want access to their peers and experts, while actuaries tell me they wish they had a forum to facilitate engagement. We need to bring together all the people that make up the industry: trustees, sponsor, industry experts, academics, investment consultants, actuaries, lawyers, bankers, asset managers to name but a few. Only through wide-ranging and honest dialogue and debate in 2011 will we be able to find the most creative, innovative and robust solutions for both legacy DB and newer DC schemes.

So Father Christmas, can you help fill everyone’s stockings this year? Happy New Year!

Rob