A decade of Liability Driven Investing

Why we need six honest serving men to solve the pensions challenge

Thanks to Rudyard Kipling’s six honest serving men we have a mindset, toolset and skill set to understand and solve the challenges that face our pension funds.

Continue reading “Why we need six honest serving men to solve the pensions challenge”

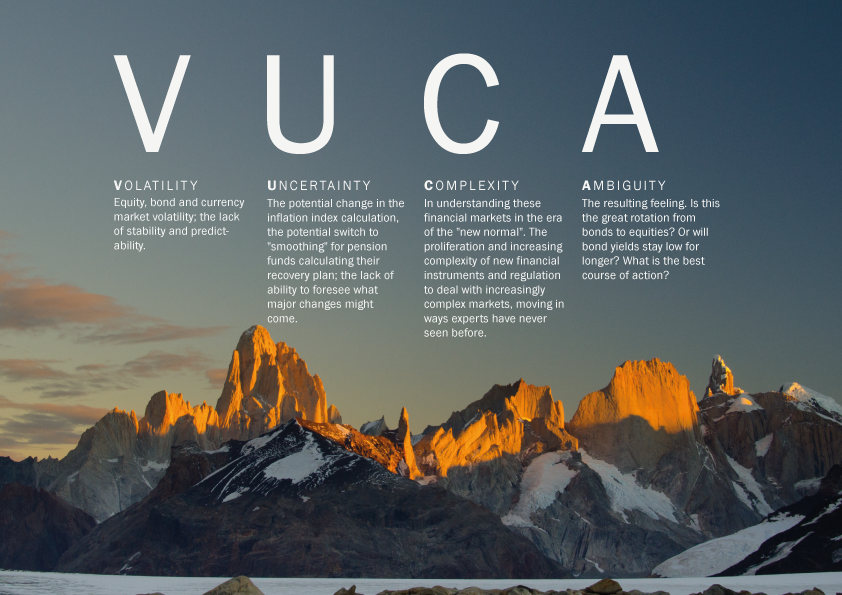

VUCA – The Acronym of our Time

For those managing personal or institutional money, the world is becoming more Volatile, Uncertain, Complex and Ambiguous.

Staying Classy – Sharing Ideas and Repairing Pensions Deficits

Last week, we at Redington released an annual publication called Asset Class 2013. It was put together by Redington Head of IC David Bennett and his team of consultants, who deal with over £270 bn of assets and the people who run those assets, on a daily basis, helping them to repair deficits and improve member security through smart investment strategy.

Continue reading “Staying Classy – Sharing Ideas and Repairing Pensions Deficits”

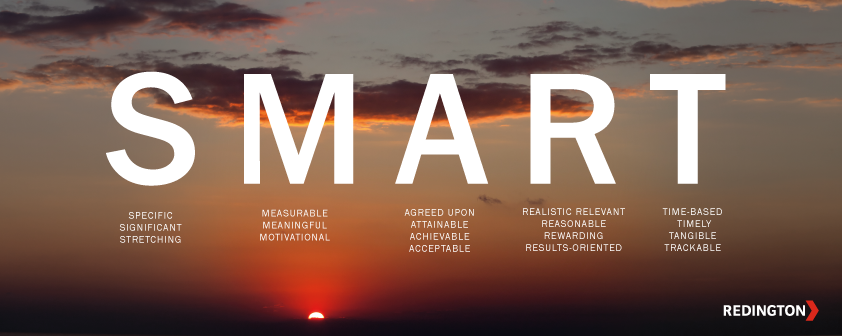

Are you SMART? How pension funds can set the right kinds of goals.

Pension funds face an eternally difficult process of setting goals and then making sure they reach them. It doesn’t sound complicated, but it is.

Continue reading “Are you SMART? How pension funds can set the right kinds of goals.”

What are Pension Funds’ Greatest Challenges in 2013?

Pensions has always been a tricky business. But perhaps never more so than in 2013. The regulation changes of the early 2000’s rewrote the rulebook for those running pension funds, and a survey of the key challenges of that time would have produced, it seems logical to assume, a set of concerns about changing regulations, accounting issues that accompany them, and governance. Today, the landscape has changed. Pension funds, on the whole, got to grips with those systemic changes in pension infrastructure only to be faced, in 2008 onwards, with the greatest seismic economic shift of our lifetimes. It wasn’t just that markets plummeted and equities didn’t turn out to be the knight in shining armour pension funds had hoped and planned they would be; it was that the very foundations of modern economic markets changed. Everything we thought we knew about risk, return and the relationship between the two, was called into question. Now, in 2013, we are all still acclimatising to our new normal.

Continue reading “What are Pension Funds’ Greatest Challenges in 2013?”

Match.com? Making the pensions and infrastructure romance work

Since George Osborne’s autumn statement in 2011, pension funds and their advisors have been discussing the idea of investing in infrastructure. And the logic for this investment is sound: pension funds need low risk, long dated inflation-linked cash flows. They always have, they always will. Happily, the UK needs new infrastructure, much of the funding for which is long-dated and inflation-linked. Banks, which previously funded these endeavours, are no longer funding them, and pension funds seem to be the natural rebound relationship that might just turn steady. Why, then, has making this partnership happen been so tough?

Continue reading “Match.com? Making the pensions and infrastructure romance work”

The genius of the AND versus the tyranny of the OR

Current debate over Defined Benefit (DB) pensions has captured the attention of the public and press. People are living longer, investment returns are lower than expected, and economic uncertainty has led to the closure of DB pension funds to future accrual in order to cap the ever rising cost of servicing these liabilities. Following these lethal blows, 2012 saw the introduction of auto-enrolment, and in 2013 the Department for Work and Pensions (DWP) is consulting on the topic of whether the industry should change the discount rate used to value liabilities to a smoothed one, in order to reduce the impact of current low gilt yields.

However, we are still faced with two serious challenges that have yet to be fully faced:

Continue reading “The genius of the AND versus the tyranny of the OR”

Step 1 – Preparation – Clearly written goals and objectives

The Pension Risk Management Framework “PRMF”

“If one does not know to which port one is sailing, no wind is favourable.”

– Seneca

Pension funds should start the process of taking control of their fund by defining the situation clearly and realistically, by setting clear goals and objectives that can be written down into a robust Pension Risk Management Framework “PRMF” document. First of all, the PRMF must clearly state the date that all parties agree full funding should be reached, for example, 2032. From there, a number of key factors can be identified and agreed.

The required rate of return needed from the assets as well as the necessary contributions to reach this date, for example Libor + 3.00%, must be calculated and included in the PRMF. Next, the framework clearly lays out the risk appetite of the trustees and the sponsor, so that all stakeholders understand each other’s goals and constraints. For example a pension fund might agree that their risk appetite is a 10% relative drop in funding level or a £100 million absolute drop in funding level in any one year. Next, the liquidity requirements needed to pay the pensioners and meet any potential collateral requirements are identified, measured, and laid out in the document. This is increasingly important since most pension funds in the UK are closed to future accrual which may result in (deficit) contributions being less than the pensions in payment. This situation is known as negative cashflow and introduces another risk which is the path dependency of the investment returns versus the liabilities. This requires the pension fund to think about assets that have greater income security year-on-year, for example credit, see steps 4 and 5. All assumptions, like the equity risk premium or the likelihood of mean reversion in bond yields, must be realistic rather than aspirational.

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

– William Ward

This PRMF document forms the operating system, a pension’s iTunes if you like, for any funding, investment and risk management decisions and actions. The PRMF allows the stakeholders to move away from a traditional asset based asset allocation framework to a risk based asset allocation framework; all key factors are considered simultaneously and, vitally, all decisions are completely informed. Without a well thought-out PRMF in place, pension funds are likely to struggle to generate the returns needed to meet their liabilities without running too much risk. In this period of economic and political uncertainty it is difficult to foresee what challenges and delays to the investment and funding plan lie ahead. It is therefore crucial to constantly be reminded of the fund’s goal, the fund’s PRMF.

In agreeing an effective PRMF, trustees and sponsors – in conjunction with their advisors – must be productively paranoid. The process necessarily leads them to ask questions like “How could this situation get worse?” “What if the Eurozone debt crisis deepens?” “What if this low growth environment in the UK and globally persists, and gilt yields start to resemble the Japanese curve?”. The stakeholders must be comfortable that solutions to these situations exist, and that the PRMF they are laying out is sufficiently inclusive to allow for effective action when the time calls.

With the PRMF in place, stakeholders are now able to make informed, effective and fast decisions. Continually readjusting the sails is the most important part of navigating towards a goal, and pension funds must be able to do this effectively; it sounds simple, but without all the goals, risks and constraints laid out in a PRMF document, pension funds have struggled to make decisions at all. The next step in this initial phase of preparation and planning is to agree and make clear responsibilities for making and carrying out decisions, setting hard deadlines for completion and review.

“I may say that this is the greatest factor — the way in which the expedition is equipped — the way in which every difficulty is foreseen, and precautions taken for meeting or avoiding it. Victory awaits him who has everything in order — luck, people call it. Defeat is certain for him who has neglected to take the necessary precautions in time; this is called bad luck.”

— from The South Pole, by Roald Amundsen

Finally, as we will see later on, in step 7 is to follow-up, monitor the decision, compare actual results with expected results, and then generate new solutions, new courses of action, and readjust the sails.

Unsurprisingly perhaps, clients who have implemented the PRMF and the 7 steps approach have been able to enhance their governance and achieve better results. Stating the goal and possible problems clearly significantly improves a pension plan’s governance structure by encouraging accountability, transparency and discipline between all key stakeholders. The framework, rather than constraining the pension fund, allows the stakeholders to be creative and develop many new solutions, as we will see later in the 7 steps, to meeting the goal of generating consistent and sustainable real returns to pay the pensioners and reach full funding. And it’s not just conjecture: research by Professor Gordon Clark from Oxford University shows that an enhanced governance framework can lead to a governance premium on investment returns, thereby materially improving the funding position of a fund.