What lessons can be learnt from the Olympics? the importance of mindset, skill set and toolset

On Friday 27th July 2012 the London Olympics inspired the world. Athletes in Team GB, such as, Jessica Ennis, Mo Farrah, and Andy Murray demonstrated to the world the ability to win gold medals and achieve incredible goals. What is the common thread of high performance that these and all other olympic athletes demonstrate? Can we learn from them and apply them to solve the global pensions challenge? I have identified 3, the importance of mindset, skill set and toolset:

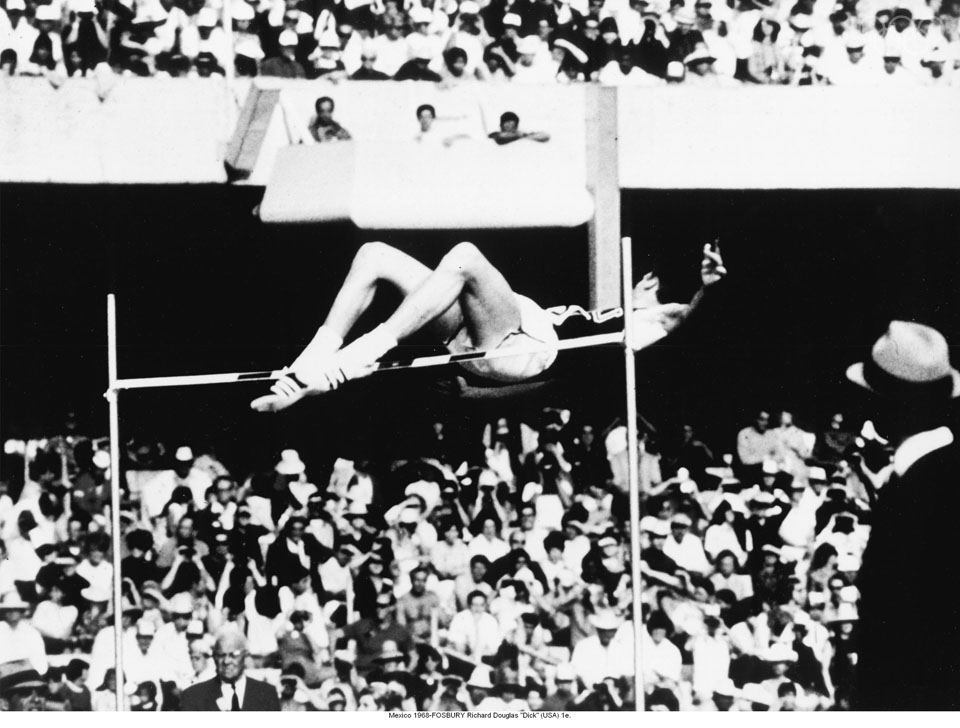

A tale of two Revolutionary Ideas – 1968 the “Fosbury Flop” and 2003 “Liability Driven Investing”

Dick Fosbury commented on the High Jump Final in Mexico 1968 “I guess it did look kind of weird at first,” he said, “but it felt so natural that, like all good ideas, you just wonder why no one had thought of it before me.”

Dick Fosbury commented on the High Jump Final in Mexico 1968 “I guess it did look kind of weird at first,” he said, “but it felt so natural that, like all good ideas, you just wonder why no one had thought of it before me.”

Liability Driven Investing “LDI” is to pension fund asset allocation and risk management what the “Fosbury Flop” is to High Jump. Mexico Olympics 1968: Richard Douglas “Dick” Fosbury (born March 6, 1947) introduced a revolutionary approach to High Jump which resulted in his winning a Gold Medal and setting a new Olympic Record at 2.24 meters (7 feet 4.25 inches). His then new and unique “back-first” technique, now known as the Fosbury Flop, is adopted by almost all high jumpers today. During the 1960s there were several high jump techniques, the scissor kick, western roll and the straddle, but Fosbury’s technique was to sprint diagonally towards the bar, then curve and leap backwards over it. The standing Olympic record before Fosbury introduced his Flop was 2.18m, held by Valeriy Brumel, who used the straight-leg straddle technique to win the Tokyo 1964 Olympics.

As a young boy, Dick Fosbury was taught both the western roll and the scissors style. In a 2008 interview with Simon Burnton of the Guardian, he said “In the very next meet, as I was attempting a new personal best, I felt I had to do something different to clear the bar and I tried lifting my hips, which caused my shoulders to go back, and I succeeded. I made a new height, I tried again, and successively I was able to clear six inches higher than my previous best, and that change made me competitive, it kept me in the game, and I converted from sitting on the bar to laying flat on my back.”

In 1965 he got a scholarship to Oregon State University where he continued to work with his coach Berny Wagner. But Wagner was no fan of the flop, which he considered “a shortcut to mediocrity”. However, one day in the summer of 1966, Wagner decided to capture the flop on video for posterity. He set the bar at 6ft 6in, and filmed Fosbury sailing over it. Reviewing the footage, he realised that his pupil had cleared the bar by a good six inches. “That,” he said, “was when I first thought he was going to be a high jumper.” But Fosbury was still a long way from being an Olympic champion. By 1967 he had risen to a world ranking of 61, but even by the time of the Olympic trials, held a month before the Games began, he was not considered a likely medallist.

At the Mexico 1968 Olympic Games high jump final the bar started at 2m (6ft 6in). With his revolutionary technique, Fosbury had made four successive jumps easily sailing over the bar at 2.18m. From 61st in the world going in, he was now guaranteed a medal alongside his fellow American Ed Caruthers, and the Soviet Valentin Gavrilov. The fifth high jump at 2.20m was cleared by all three athletes, but on the sixth jump, Gavrilov failed at 2.22m.This left Fosbury and Caruthers fighting for gold. Fosbury had not missed a single jump in the competition, though, whilst Caruthers had failed five times. The sixth high jump bar was then set at 2.24m (7ft 4in), a new Olympic record height. Fosbury with his longer run-up and lengthier preparation sailed over the 2.24m bar. But Caruthers failed in his attempt. History was made when Dick Fosbury became Olympic Gold Medallist with a revolutionary new and superior approach to high jump.

Fosbury’s innovation, though, was not immediately embraced by high jump athletes. Four years later, in the 1972 Munich Olympic Games, twenty eight of the forty competitors used Fosbury’s technique, but Juri Tarmak of the Soviet Union won Gold using the straddle technique. Since then, though, all Olympic medals in this discipline have been won using the Fosbury Flop. Today it is by far the most popular technique in modern high jumping.

Mexico 1968 high Jump Final (Fosbury 2.24m Ed charuters 2.22m).

Why? There were several high-jump techniques: scissors, western roll and straddle. All attacked the bar from the side or face on and all use the inner foot to take off. Conversely, in the Fosbury flop, the athlete runs up in a curve, jumps by taking off from their outer foot and twists their body to clear the bar with their back. They finish the movement by lifting their legs over the bar and landing on a mattress. The back-first jump offers many improvements compared to traditional techniques: the curved run-up allows the high-jumper to reach the bar with more speed and to do a more powerful jump. The body arches over the bar and the centre of gravity is underneath, which is an indisputable mechanical advantage. In just one Olympic Games, Dick Fosbury excelled by revolutionising the high jump discipline, making his mark on both the history of athletics and the entire future of the sport.

Friends Provident swaps away pensions risk

On the 3rd December 2003 the Friends Provident Pension Fund made history by implementing a brand new technique to manage the long-term health of the Fund. The UK life assurance company implemented derivatives to hedge out its pension fund liabilities against interest rate and inflation risk.

Following the analysis by Dawid Konotey-Ahulu and the Merrill Lynch RedAlpha team, Friends Provident designed and implemented a far more effective solution for ensuring the pension fund’s long-term strength than the cash flow or asset mixes that other companies were focusing on at the time. According to Graham Aslet, the Company Appointed Actuary, the question you should be asking yourself is not whether to use bonds, like Boots a few years earlier, or equity, like most pension funds, but how big your swap should be. Like Dick Fosbury, Graham Aslet and Friends Provident were looking for a revolutionary approach to achieve success. A year later Graham Aslet said in an interview “I don’t think we had previously considered that route because of the slight stigma that is still attached to the use of derivatives. The necessary hedging involved in life assurance is one thing, but having to convince naturally conservative trustees of their use and safety is another.”

Why would you voluntarily run £1 million a basis point of risk in your pension fund?

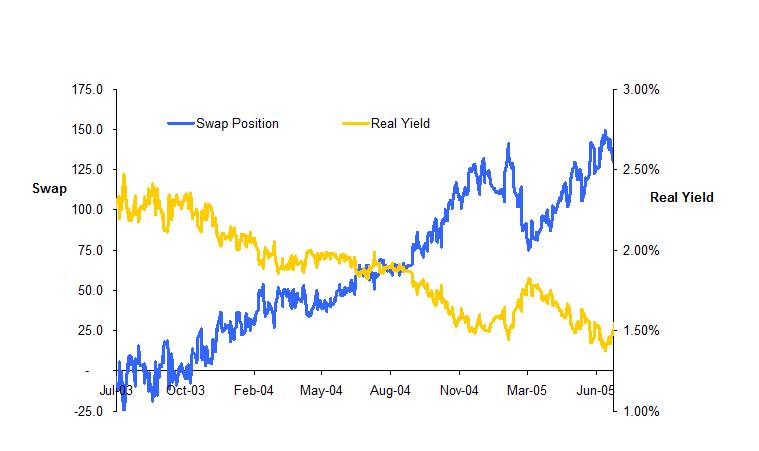

Although the technique was new for pension funds it was not new for corporates. Dawid Konotey-Ahulu, then Managing Director of the Merrill Lynch Insurance & Pensions Solutions Group, argued that, if a fund has the same status as a corporate bond, it is odd that companies are happy to run risks in their pension fund that they would never dream of running within the rest of the company. He said in a press interview “Almost every major issuer of international debt covers itself against currency and interest rate risk, taking out derivatives to switch its exposure from fixed to floating rates, but not one covers itself against pension fund risk”. That risk is derived from a pension fund’s real yield, which is determined by nominal interest rates and long-term inflation expectations. A good proxy for UK pension fund yields is the yield on the gilt, shown in the chart below. As it shows, the real yield on the 2035 index-linked gilt has fallen from 2.12% to 1.52% in the space of a year. If a company had a £500 million pension fund, that 60bp fall in real yield would result in a fall in the value of the fund of £60 million. It would be a disastrous equity market that produced that scale of damage for a fund in the space of a year.

Using Liability Driven Investing using swaps to hedge the liabilities, not equities or bonds, is the answer

Many companies had begun to recognise the problem. But their answer was either to concentrate on getting the maximum return from the equities that make up their pension fund, or to cashflow match using bonds to extend the income from their assets out to a predictable amount over 20 or 25 years. But equities were not the answer: the European markets had risen in 2003 and 2004, but despite that, pension fund deficits still relentlessly rose. Neither are longer-dated bonds the solution: the risk to a fund from real interest rates is at 60, 70 or 80 years in the future. Buying bonds that expire in 25 years will not help. At the time, the 30 year Index-Linked Gilt was the longest duration bond. UK retailer Boots is a good example of a company that bought bonds in order to try and cash-flow match, but reverted to equity when the bonds failed to solve its dilemma.

Chart showing the LDI swaps hedge mark-to-market valuve versus the Real Yield

Source: Merrill Lynch RedAlpha 2005

The reason for the rise in pension fund deficits despite improving equity markets in 2003 and 2004 was because the size of the liabilities had risen by more than the rise in equity markets. Furthermore, because most pension funds were underfunded, i.e. their assets were less than their liabilities, the real yield volatility impacted 100% of the liabilities which might be 25% greater than the asset value of the pension fund. Dawid commented at the time that “A lot of companies understand that interest rates and inflation are hurting the pension fund; what they don’t understand is the detail of how and where. They need a strategy to immunize the volatility in the liabilities: an asset whose value moves in the opposite direction to the liability and which they can tailor to match their specific sensitivities,”.

The use of swaps by pension funds was novel as, on day one, the swaps began with a value of zero. Their value then alters as inflation or interest rates change. The key for pension funds is to design a portfolio of swaps that mirrors the mark-to-market change in the value of the liabilities. Interestingly, this concept was known as duration matching, and was originally proposed by the Life Actuary Frank Redington in the mid 1950s. The only difference with this modern approach is that the duration matching tool was an interest rate swap and an inflation swap.

One reason many other pension funds at the time would not consider hedging using swaps was that they believed wholeheartedly real interest rates were as low as they were going to go. It was quite a risk to take, to try and call the market when you could be losing £1 million for every basis point the real yield falls. In an interview in 2004 Dawid said “A year ago lots of companies looked at the real yield at 2.15% and said it was at historic lows. One or two even took the view that it would be impossible for the real yield to fall below 2% and therefore decided not to hedge. But it fell to 1.9%, 1.7% and it’s now at 1.5%. Given that you really have to say there is a chance the real yield could fall a lot further”. What’s more, the nature of interest rate yield curves is that it is negatively convex: the lower the yield gets, the greater the proportionate cost of each basis point drop. A pension fund’s sensitivity may be £1 million a basis point now, but if interest rates fall another percentage point that sensitivity would rise to £1.4million. Sadly, this is what has happened to many pension funds since then. A year after the Friends Provident transaction, when asked why more pension funds had not adopted this new approach, Aslet said the idea of derivatives may be a stumbling block for some companies: “Our in-house expertise on derivatives and our asset management business helped to convince the trustees that we knew what we were doing”. If that psychological barrier could be overcome, he thought the same structure could be used by any company with a large pension fund.

What is strange is that, in 1968, Fosbury’s technique looked weird and new. People were cautious. But Fosbury’s innovation and guts to pursue it paid off for him, and for the early adopters that came after him, in the form of Olympic medals. Anyone watching the London Olympic 2012 would have thought it weird to see anyone attempt the high jump without using the Fosbury Flop. Watch the clip from the London 2012 Olympic Games Men’s High Jump Final, 7th August 2012. Ivan Ukhov (Russian Federation) wins the gold medal with a 2.38m High Jump. Erik Kynard (United States) takes silver with 2.33m. Mutaz Essa Barshim (Qatar), and Robert Grabarz (Great Britain), have a three-way tie for bronze at a height of 2.29m. They all use the Fosbury Flop.

Athletics Men’s High Jump Final – London 2012 Olympic Games Highlights

Similarly, in 2012, the LDI technique has become widely adopted with over 600 LDI mandates representing over £300 billion of LDI assets (source KPMG 2012). Despite the general appetite to reduce risk in pension funds, many made the call that real yields couldn’t fall any lower. Sadly they did. However, this represents a small proportion of UK pension fund liabilities. Pension funds will consider a buy-in or buy-out where the principal risk management tool used by the insurance company is LDI, but will often not consider LDI as part of their pension fund asset allocation and risk management framework. Why? Is it because they are still wary of the still relatively new LDI technique, or is it a belief that rates will mean-revert to higher levels?

Mexico 1968 Citius! Fortius!

Fosbury’s new Olympic record took its place in an Olympic Games that saw many new world and Olympic records: indeed, in the long jump, America’s Bob Beamon jumped an incredible 8.90m, a record that went on to stand for 22 years! His compatriot James Hines was the first man to run 100 metres in under 10 seconds (9.9). Tommie Smith, broke the men’s 200 metres world record (19.8 seconds); Lee Evans, that of the 400 metres (43.8 seconds); and Britain’s David Hemery that of the 400 metres hurdles with 48.1 seconds!

Step 2 – Access to a Liability Driven Investing “LDI” hub

“….. the investment of the assets in such a way that the existing business is immune to a general change in the rate of interest”

“….. the investment of the assets in such a way that the existing business is immune to a general change in the rate of interest”

Frank Redington

Journal of the Institute of Actuaries 1952

The liabilities of a pension fund suffer three main risks: interest rate risk, inflation risk, and longevity risk. If interest rates fall, inflation rises, or people live longer, the liabilities of a fund increase significantly.

The LDI hub for a pension fund trying to make full funding has three core roles:

- First, it gives the pension fund the ability to use a large toolkit of instruments, including bonds (gilts) and derivatives (swaps) to hedge these risks.

- Second, the LDI hub allows the pension fund to manage its collateral (cash and gilts), which will become increasingly important in 2013 as pension funds start moving to central clearing. [SeeTom’s blog – READY OR NOT, EMIR I COME]

- Finally, the LDI hub can be used to implement other derivative overlay strategies in the portfolio. For example, a pension fund could synthetically gain exposure to an equity market using an equity future on the S&P500 or a buy put option on the FTSE100 , as a way to gain or in order to protect the downside of their UK equity portfolio.

The role of the LDI hub should be separate from the timing of transactions, and regarded as an ongoing risk management toolkit – not a short-term de-risking task.

For most pension funds the largest risks to the funding level, unless they have been hedged, are interest rate and inflation risk arising from the liabilities. A sharp reduction in risk can be achieved by increasing the hedge ratio: the ratio of interest rate and inflation sensitive assets relative the interest rate and inflation sensitivity of the liabilities. A pension fund that is 80% funded with a traditional 65% equities and 35% fixed income benchmark might only have a hedge ratio of around 20%. In order to immunise the funding ratio to changes in interest rates and inflation, this ratio must be increased to 80%, the risk-neutral hedge ratio. If a pension fund’s goal is to immunise the absolute deficit, then the hedge ratio needs to be increased to 100%. Over the last decade, LDI has become widely adopted with over 600 LDI managers mandated and over £300 billion in assets under management by LDI fund managers (2012 KPMG LDI survey). However, today’s environment is one of low level nominal rates and real yields. The challenge, then, is fitting a view on rates, inflation and real yields against a risk budget and the impact of calling the markets wrong.

“In a strict sense, there wasn’t any risk – if the world had behaved as it did in the past”

Merton Miller

Economist & Nobel Laureate on the demise of Long Term Capital Management

If a Pensions Risk Management Framework (PRMF) document has been laid out thoughtfully, it will encompass all the instructions an LDI manager needs to implement an effective strategy: timing, choice of when and what to hedge, and at what market or funding levels. It will be driven by the goals, objectives and risk budget set out in the framework. An LDI hedging framework for a traditional pension fund might include a disciplined, averaging-in approach over ten years. For example, this may involve increasing the hedge ratio by 6% a year, from 20%, to reach an 80% hedge ratio in ten years’ time. In combination with Step 7, monitoring, the LDI Hub that is informed by the PRMF can be built into a dynamic de-risking strategy, one that allows the dynamic increase of the liability hedge ratio via the LDI hub. Using this technique, it would be possible to move faster in the event of sharp rise in real yields to capture the increase in funding ratio, and to capture the outperformance of the assets against the liabilities. A pension fund, for example, could effect the dynamic switching from equities to increasing the hedge ratio via the LDI hub. Within a well designed PRMF, this strategy could allow re-risking to occur when the PRMF and conditions call for it: a pension fund could, for example, add more equity exposure using equity futures or total return swaps. This dynamic approach can also be applied to other parts of the strategic asset allocation, for example, by switching from shorter dated credit risk premia to longer dated and often illiquid credit risk premia in order to lock-in the re-investment risk needed to fund the plan. See steps 4 and 5.

Like a skilled sailor, the pension fund will always have a clearly defined goal, but will adapt with the seas to achieve it.

Action

“They always say time changes things, but you actually have to change them yourself”

Andy Warhol

- If you do not have an LDI hub in place, which may be because you believe rates are extremely low and will likely rise again, I recommend researching and appointing one anyway. That way, you can put in place a dynamic risk management framework that is able to take action when the opportunities arise.

“Markets can remain irrational longer than you can remain solvent.”

John Maynard Keynes

- If you have an LDI hub in place, review it to make sure the LDI manager has access to the broadest possible toolkit of instruments but is also constrained by a carefully considered and appropriate Investment Management Agreement (IMA). Be prepared for central clearing.

NAPF Investment Council – I am standing for election and would love your support

As a member of the NAPF investment council, I will endeavour to make a valuable contribution to getting better outcomes for both defined benefit and defined contribution members.

As a member of the NAPF investment council, I will endeavour to make a valuable contribution to getting better outcomes for both defined benefit and defined contribution members.

I have spent the last 8 years developing, creating and implementing investment solutions to meet the ever changing regulatory, governance, and (financial) market conditions. In 2003 I was involved with the first derivative LDI transaction with Friends Provident whilst working at Merrill Lynch which remains one of my career’s most valued achievements. In 2006, I followed my passion and setup up Redington, alongside my business partner, aspiring to become a well respected and progressive investment consultancy. Whilst at Redington I have worked with both small and large clients and gained an invaluable insight into the multi faceted challenges (especially investment) facing the pension industry today.

I am passionate about fostering solutions such as investing in social housing and un-leveraged UK infrastructure assets to source long-dated inflation linked cash flows. I believe the NAPF council is the right forum for discussing the utilisation of such solutions, and think my experiences will bring forth a unique, yet collaborative perspective of many trustees and corporate clients whom I have been fortunate to work with.