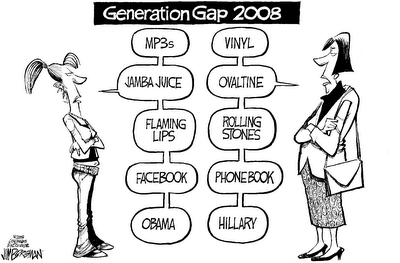

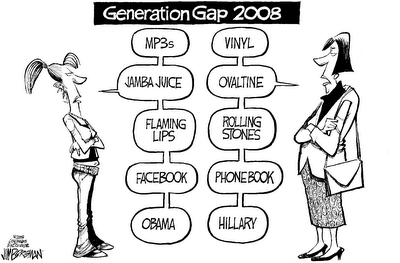

By 2025, Generation Y will hold the Office of the President of the United States, Number 10, and will make up the largest percentage of the UK’s working population.

But who and what is generation Y? Why are the implications of their financial behavior so important for Britain’s future?

Alternatively known as the ‘Millennium’ or ‘iPod Generation’, Y-ers are the generation born between 1976 – 1991

Saving for Tomorrow?

More than previous generations, Generation Y is loaded with debt and the concept of savings (especially for retirement) remains elusive.

Generation Y grew up in an era of nearly unprecedented prosperity and economic growth. Many still live with their parents spending a large chunk of their disposable income on instant gratification and avoiding any real financial responsibilities. Unaccustomed to compromise and unphased by authority, they are slow to conform and indeed seem to take pride in their “short-termism”. With the exception of the lucky few, Generation Y have no access to defined benefit pensions and it they have any retirement savings at all, chances are it’s in the form of an paltry contract based defined contribution scheme – where the individual, rather than their employer bear all the associated investment risk.

Until now, the pensions industry has has focused on the needs of Generation X (those individuals born 1961 to 1991), who are fast waking up to the reality that as fast as they save, their nest egg is busily being depleted by both KIPPERS (kids in parents pockets eroding retirement savings) and their retired Babybooming parents – who, thanks to the wonders of modern science, are now living, on average, at least 7 years longer than before.

But generation Y cannot be ignored for too much longer..

..In less than 15 years, they will generate the biggest slice of the Treasury’s tax receipts, and by 2050, make up the largest proportion of those in meaningful employment. Therein lies the crux of the matter. No matter how you approach the sums, the figures don’t add up. To finance state pensions, the government robs Peter to pay Paul, so that the National Insurance contributions from hardworking Gen X-ers and Gen Y-ers go straight out the door in the form of state pensions for the Babyboomers, who are now living on average until 78. In 1908 when the UK first introduced pensions average UK life expectancy was 50.

Blame the Babyboomers?

It is important to put the problem in context. Babyboomers had the ‘luxury’ of 40 years to save for retirement, benefitting from globalisation, freely available (and cheap) capital and an unprecedented housing boom.

Fast forward to 2010 – Generation Y faces a markedly different future. Accumulating debt throughout their twenties, due to either the costs of further education or the era of cheap credit, few generation Y-ers are in a position to accumulate wealth for their retirement until their late twenties, or even early thirties! They face the unenviable task of condensing 40 years of wealth production into about 25 years in uncertain economic environment and are shut out from the golden plated defined benefit pensions their parents and grandparents will receive.

For the government of tomorrow the future looks grim, as every generation continue to live longer than before, escalating government-financed pensions and spiralling healthcare costs coupled with insufficient pension pots are set to tip its books permanently into the red.

Is Generation Y doomed to a future of geriatric poverty?

Well, not necessarily. The Government has already taken the first tentative steps towards balancing its books. With the backing of all the mainstream political parties it recently took the bull by the horns and is phasing male state retirement age to 68 by 2046, although I am happy to take bets that by then the national retirement age will be linked to the population’s actual longevity statistics – pushing the retirement age far higher.

In 2012 the Government will introduce NEST (the National Employment Savings Trust) previously known as Personal Accounts. This initiative is part of the Government’s broader pension reform strategy which will significantly change the way people save for their pensions and retirement in the UK. Compulsory for all employers with five or more employees, NEST (in its current framework) will automatically take 4% of employees’ pre-tax earnings, a 3% employer contribution, and 1% in tax relief, to provide a ‘whopping’ 8% of annual salary pension’s contribution. NEST tackles inertia and reluctant investment through auto-enrolment, introducing the concept of libertarian paternalism, “nudging” the youth of today into making better choices, without losing the right to choose.

Yes, these are all steps in the right direction, but pensions contributions under NEST (8% of annual salary), falls someway behind the 20 – 25% of annual salaries that corporate used to fund the now elusive gold plated defined benefit provisions.

All I Really Need to Know I Learned In Kindergarten

We need to do more, younger.

With the oldest average aged population on the planet, Japan recognised sometime ago that it was imperative to educate Generation Y about the importance of saving for retirement. All school age children (aged 11 – 18) are taught about pensions and saving by local Municipality Officials. In addition, all nationals aged between 20 – 59 are required to en-roll in the national pensions plan.

By contrast, in the UK such education is not compulsory, only featuring superficially in schools PSHE lessons, (personal Health and Social Education). This type of education must become mandatory, spelling out in simple language the importance of saving regularly from a young age. The power of compounding is easy enough to grasp, even for those who are not contemplating a future career as an actuary. For those who can be taught the benefits of regular investing from a younger age, the future looks a lot brighter.

Generation Y needs to radically change the ways in which they plan for their future financial security.

Help get your scheme to full funding on your daily commute in RedMaze.

Help get your scheme to full funding on your daily commute in RedMaze.