The challenges of the pension industry are well known. People are living longer; historically the industry has placed too strong a focus on assets and failed to pay adequate attention to liabilities; there has been an obsession with return but scarce heed paid to risk. Defined benefit pension funds remain vulnerable to falling funding levels from several sources: low interest rates, inflation, volatile equity markets, and an uncertain economic outlook that renders returns uncertain too. Therefore, the risk of generating insufficient real returns to meet the liabilities and to pay pensioners has never been greater. So how should pension funds be acting in the face of this uncertain environment? How can a pension fund be prudently managed today, so that it manages its risks and still achieves the return it needs to succeed?

The challenges of the pension industry are well known. People are living longer; historically the industry has placed too strong a focus on assets and failed to pay adequate attention to liabilities; there has been an obsession with return but scarce heed paid to risk. Defined benefit pension funds remain vulnerable to falling funding levels from several sources: low interest rates, inflation, volatile equity markets, and an uncertain economic outlook that renders returns uncertain too. Therefore, the risk of generating insufficient real returns to meet the liabilities and to pay pensioners has never been greater. So how should pension funds be acting in the face of this uncertain environment? How can a pension fund be prudently managed today, so that it manages its risks and still achieves the return it needs to succeed?

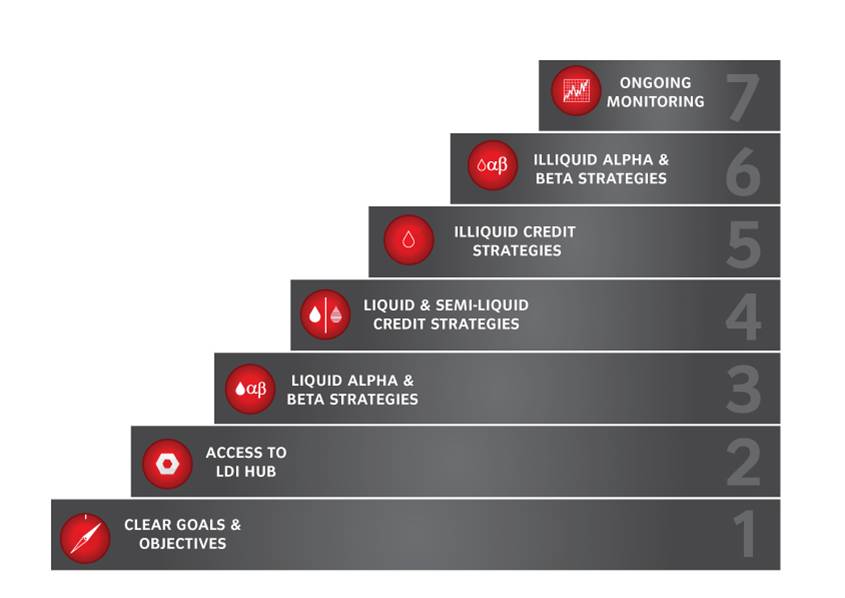

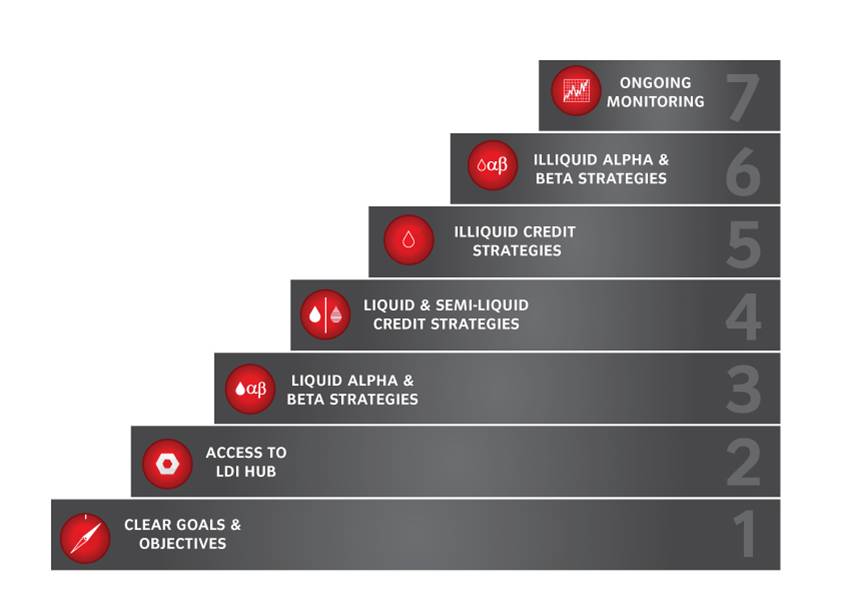

In the next 7 weeks, I will lay out the 7 steps to full funding framework that we implement with our clients and which has produced significantly better funding levels for them. I will take each step as a separate post, explaining why and how they should be put into action. This framework places control of assets and liabilities back into the hands of the pension fund, allowing them to control risk and return and, ultimately, pay their pensioners and avoid insolvency through these uncertain times. If pension funds adopt this approach, they will have taken the first step in improving the health of their fund and the well being of their members.

“The beginning is the most important part of the work.”

– Plato, philosopher

4 Replies to “The 7 Step Framework to Full Funding for Pensions”

Comments are closed.